I was ecstatic when I got my first job as a personal trainer. It was a successful big-box gym in Boston, and I would be joining an experienced, supportive team.

The contract I signed promised me a good income. For someone who’d been living on a few dollars a day just two years before, it seemed like a mountain of money.

Until I got my first paycheck.

Within 12 months, I’d put $20,000 on my credit cards—a debt it took me two years to pay off. In the process, I learned the money-management skills they don’t teach in our certifications.

Take it from me: How you handle money, especially when you’re starting out, can make or break your career as a personal trainer. Without a solid grasp of your personal finances, you may not last long enough in the fitness industry to make a contribution.

I hope the following eight lessons help you profit from my mistakes.

1. Prepare for tiny paychecks

A bit about my background:

I came to the U.S. from Belarus in 2010. By 2014, when I started full-time at the gym, my English was still limited. Friends from back then joke about how they thought I was shy; once my language skills caught up with my personality, they discovered my not-so-shy self. (And we remained friends, I’m happy to report.)

That helps explain why I didn’t fully understand the contract I signed. But you can bet I figured it out when I got my first check and realized my pay was barely above minimum wage—before taxes.

The fortune I expected was based on a full roster of clients paying me for at least 27 hours of personal training a week.

You can draw two lessons from the reality of my first check:

- Unless you start out on a fixed salary, you have to understand that the big bucks in your contract won’t come right away, and may not come at all.

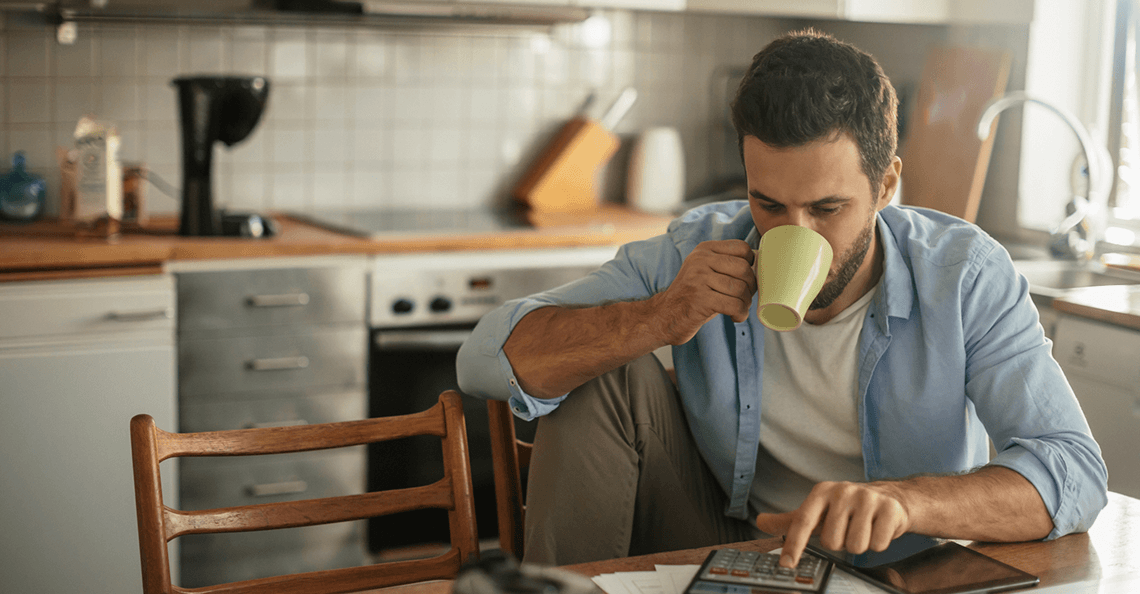

- No matter what you agreed to or expect, you should know how much your take-home pay will be so you can plan accordingly. A simple calculator like this one will give you a pretty good estimate.

Once you know what you’re going to bring home, you have to figure out how to live on it. Which leads to my next point.

READ ALSO: Personal Trainer Salary Survey: Who Earns the Most?

2. You’ll make more by spending less

I now think of myself as a financial minimalist. But it wasn’t always that way. My first few months as a trainer, when I opened the gym at 5 a.m., I started every morning with a Starbucks coffee, and usually bought another pick-me-up in the afternoon so I could power through my schoolwork. (I was studying for a degree in exercise science.)

Soon enough, I realized I was spending a whopping $400 a month on coffee. Coffee I could’ve made at home for 20 cents a cup, instead of dropping $4 at Starbucks.

That, combined with takeout lunches and dinners when I was too tired to cook, are a big reason I piled up so much debt my first year as a trainer.

My mistake—and it’s a common one—is that I didn’t understand the difference between needs and wants.

Here’s what you need:

Shelter

This includes heat, electricity, water, and Wi-Fi.

Food

Most of us train hard. And if you train hard, you need a lot of food, along with water and, of course, caffeine. What you don’t need is food in or from restaurants. Not if you can’t afford it on your take-home pay.

Transportation

You probably think your car is essential. And if you live in a medium city or small town, it probably is.

But if you live in a big city, a car can be more trouble than it’s worth. Insurance is expensive, and parking is not only a headache, it can cost a fortune (especially if the police budget depends on revenue from parking tickets).

In a city with good public transportation, you may not need a car at all, especially if you can walk or ride a bike to work.

Clean clothes for work

No one needs to go into debt to fill a closet with clothes to impress people. You only need to look professional at work. If your gym provides shirts, the only clothes your clients will see are your pants and shoes.

For everything else, what you already have is probably good enough for now. Get brutally honest with yourself about what you truly need, and what you can put off until it fits into your budget.

READ ALSO: Are You Making Yourself Rich, or Poor? Here’s Why Every Choice You Make Today Matters

3. Poor money management makes you a bad trainer

Like many new trainers, I had a quota to hit. My income depended on it, and my manager reminded me of it every week. The pressure to hit that quota and make more money stressed me out. The stress, in turn, made me a bad trainer.

Making another sale was the only thing on my mind, and you’d better believe my clients and prospects noticed. They could sense my desperation, which got worse every time I heard “I need to think about it.”

The more I thought about money, the lower my conversion rate. The lower my conversion rate, the more it carried over into my performance with the clients who were already paying me.

Unfortunately, it took me a long time to figure all this out.

But a light bulb came on about a year into my personal training career. This PTDC article on how to sell training was part of it, along with other articles on how to establish rapport with prospects and turn them into clients.

The moment I put my prospects’ and clients’ goals first, and made sessions more fun, I nearly doubled my training hours in just a month.

Happy clients who reach their goals are the key to a successful personal training career, one that gives you a comfortable income, and perhaps even more.

READ ALSO: How to Make $100,000-Plus Per Year as a Personal Trainer

4. The money isn’t yours until you’ve paid your taxes

A few years ago, when I decided to leave the gym, I asked every successful self-employed fitness pro I knew the same question: “What do you wish you’d done differently, based on what you know now?”

Everyone had the same answer: “Be sure to set aside money for taxes.”

This isn’t an issue when you work for a gym that collects your clients’ fees and deducts taxes from your paychecks. But when you’re an independent trainer, you’ll need to handle all that yourself by making quarterly payments to federal, state, and local tax collectors, and then squaring up when you file your annual returns.

As a rule, I set aside 30 percent of every fee. Yes, it’s a lot, but I’d rather save too much now than try to come up with thousands in April.

READ ALSO: Master Your Taxes in 10 Easy Steps

5. Continuing education is your second-best investment

I also set aside 2 percent of every client’s fee for continuing education. If that’s too much to keep track of, you can try Alwyn Cosgrove’s approach: Set aside the income from one client each week. At $50 a week, that’s $2,500 a year—enough to pay for several books and a seminar or two.

I think seminars are essential, especially the ones that combine theory-based information with hands-on practice. The more you know and use, the more ways you have to help your clients reach their goals.

And you know how I feel about happy clients who reach their goals.

READ ALSO: These Are the Best Advanced Certifications, According to Personal Trainers

6. Saving for retirement is your best investment

The parent company of the gym I worked for offered a 401(k) savings plan, with matching contributions.

So for every dollar an employee put into their retirement account, the employer added a dollar. You won’t find another investment that instantly doubles in value.

Unfortunately, I never took advantage of it. With my limited English, it just seemed bewildering to me, and I didn’t know where to turn for more information. Which means, for four years, I saved nothing. My employer matched nothing. I had no money invested in the booming stock market, which would’ve multiplied my savings.

I’m trying to make up for it now that I’m self-employed, but there’s no getting around the fact I left a lot of money on the table at the beginning of my career.

Setting aside money for retirement isn’t sexy, especially when you’re still living from paycheck to paycheck. But you know what else isn’t sexy? Being a 60-year-old personal trainer who’ll never be able to retire because he didn’t start saving soon enough.

7. You need a basic guide to personal finance

If what I just described seems as foreign to you as English was to me, you’re not alone. Few of us learn the basics of personal finance in school.

But nobody instinctively understands kinesiology, either. We learn it from textbooks. That’s also the best way to start your financial education—with a guide to the nuts and bolts of money management.

Which one? My editor asked for recommendations on Facebook, and ended up with a lot of suggestions. These were the ones most often mentioned.

For basic financial literacy

The Total Money Makeover, by Dave Ramsey, got the most mentions, especially for those who need to pay down debts. But like Rich Dad, Poor Dad, another popular title with personal trainers, it has some detractors.

Your Money or Your Life, by Vicki Robin, gets a thumbs up from Dan John.

The Wealthy Barber, by David Chilton, is popular with Canadian fitness pros.

For gym owners

Profit First, by Mike Michalowicz. Gentilcore says it helped him “make sense of everything and utilize a system that's easy and works.”

For entry-level investors

The Truth About Money, by Ric Edelman.

The Millionaire Next Door, by Thomas J. Stanley.

The Little Book of Common Sense Investing, by John Bogle

READ ALSO: The Best Books for Personal Trainers

8. You’d better be ready for the next recession

Nobody knows when the next recession will hit, or how severe it will be. All we know is that there will be one.

And when it comes, as Pete Dupuis points out in this post, it’s going to hit personal trainers hard. Clients who fear for their jobs aren’t going to keep paying you.

Dupuis offers three ways to prepare:

- Cut the fat from your personal and professional budgets. Don’t wait for a recession to realize how many things you don’t need but pay for anyway.

- Make your services indispensable to your clients.

- Most important of all, differentiate yourself. Clients who see you as the only person who can help them solve their specific problems will be reluctant to let you go.

READ ALSO: How to Find the Right Fitness Niche for You

Final thoughts

At the beginning of my career, I just wanted to learn as much as I could about exercise science and the psychology of training. I regret absolutely nothing I did in my eagerness to become the best trainer I could be.

What I didn’t know is that my lack of financial knowledge would prevent me from taking full advantage of my fitness knowledge.

Believe me when I say you need both. The better you manage your money, the less pressure you’ll feel to make the next sale, and the more you can focus on your clients’ success.

Make them happy, and they’ll make you rich.